For the last few years, cryptocurrency has been all over the news and has become a global buzzword after Bitcoin reached its all-time high in the 4th quarter of 2021. Even though crypto is the talk of the internet, there are still many who remain unaware of how it is revolutionizing the way we think about money and how it will be utilized in the future.

This cryptocurrency tax guide covers everything you need to know about cryptocurrency tax laws in the USA in 2024! Let’s dive right in.

What Is Cryptocurrency?

The shortest and simplest answer to this question is: Cryptocurrency is a form of digital currency. There are two major differences between cryptocurrencies and traditional fiat currency.

- Crypto does not produce a physical bill; it is completely digital

- Cryptocurrency is a decentralized currency which implies that it does not follow the guidelines of any centralized authority like that of a bank or the government

Photo by Kanchanara on Unsplash

What Is the Importance of Cryptocurrency and Is It Safe?

The most-loved feature of cryptocurrency is its very basic concept: Being a decentralized form of currency. Owning a currency that is not controlled by any central authority provides an excellent alternative to the way we currently conduct our monetary system.

Transactions involving cryptocurrency take place on a public ledger called a blockchain. The ledger functions as a middleman that ensures all transactions are fair and free from double spending. This ledger is protected by strong cryptography which keeps all transactions safe.

Having said that, it must be noted that even though cryptocurrency is a decentralized system, there are crypto taxes in the U.S. that you need to be aware of. Now, let’s take a look at how bitcoin and other cryptocurrencies are taxed.

In Latest News: Crypto taxes: major milestones of 2023 and forecast for 2024

How Is Cryptocurrency Taxed?

Now that we have a clear understanding of cryptocurrency and its working principles, let’s explore how cryptocurrency is taxed.

The IRS Considers Crypto as Property

Cryptocurrency is subjected to taxes overseen by the Internal Revenue Service (IRS). The Internal Revenue Service issued Notice 2014-21 in 2014 that stated cryptocurrency is considered “property” and not currency.

Simply put, cryptocurrency is treated the same as stocks, bonds, and other assets that qualify for capital gains taxes. There are also instances where crypto is treated as income and thus qualifies for income taxes.

Let’s understand this concept with an example. Kate bought $20,000 of Ethereum in August 2021 and sold it in October 2021 for $25,000, Kate would realize $5,000 ($25,000-$20,000) as a capital gain.

On this capital gain, the amount of tax that Kate must pay is dependent on her tax bracket and the holding period (short-term and long-term).

But what if Kate hadn’t bought the crypto (Ethereum, in this case)?

If she had received cryptocurrency through mining, airdrops, or as interest from lending, her income would then be subject to income taxes, the rate of which would depend on the income slab she comes under.

Now, the next question that could come to mind is – how will the tax be calculated? For this calculation, it is crucial to understand three essential concepts:

- Fair market value (FMV)

- Capital gain and loss

- Cost basis

Fair Market Value

The price at which an item can be sold on the open market is called its fair market value. In the case of crypto, the fair market value is the price of crypto in its equivalent fiat currency or U.S. Dollar. It is commonly denoted by its abbreviation, FMV.

Capital Gain & Loss on Crypto

A capital gain or loss is incurred on trading or selling cryptocurrency. Just like traditional assets, capital gains will be incurred when the price of selling is greater than the price it has been acquired for (refer to Kate’s example of $5,000 as capital gains above). On the other hand, a capital loss is incurred when the price of selling is lesser than the price it was acquired for.

Before selling a capital asset, you must figure out if the investment was short-term or long-term. Long-term gains and losses are incurred when the assets were held for more than a year, whereas short-term capital gains and losses are incurred when the assets have been held for less than one year.

Cost Basis Methods for Tax Calculation

Cost basis can be defined as the amount spent to buy an asset (cost price). It also includes any additional expenses that were incurred at the time of acquiring the crypto, such as transaction or gas fees.

Various methods are followed for the calculation of cost basis:

- Average cost

- Specific identification

- First in, first-out (FIFO)

- Last in, first-out (LIFO)

- Highest in, first-out (HIFO)

How to Calculate Taxes on Bitcoin and Other Cryptocurrencies?

Now that we know the basic terminologies used for crypto tax calculation, let’s explore taxable events, various tax methods, and the concept of tax-loss harvesting.

Taxable vs. Non-Taxable Crypto Events

Most crypto transactions are taxable – but not all of them.

Taxable crypto transactions include:

- When you sell crypto for fiat currency like the U.S. Dollar, Euro, Canadian Dollar, etc.

- Trade crypto for another crypto, such as Bitcoin for Ethereum, and Ethereum for Cardano.

- Buy goods or services using crypto.

- Receive crypto because of advanced crypto situations, like a hard fork or crypto mining.

Non-taxable crypto transactions include:

- When you buy crypto with fiat currency.

- Transfer crypto from one of your wallets to another crypto wallet that you own.

- Gifting crypto (non-taxable below a limit, subject to gift tax above that).

- Donate crypto to a tax-exempt organization.

Crypto Tax Rates: Long-Term vs. Short-Term Capital Gains

The rates of crypto taxes depend on the holding period of the asset and can be categorized into two groups; long-term and short-term gains.

1. Long-Term Capital Gains

Long-term gains are applied to crypto-assets that have been held for 366 days or more. Investors who opt for long-term investments are at an advantage compared to those holding short-term crypto investments because long-term investors are subject to incentives and lower crypto tax rates.

As of 2024, the long-term capital gains slab ranges from 0% to 20%, depending on a few parameters. Here’s a list of the rates of cryptocurrency taxes for long-term crypto holdings.

| Tax Rate | Married, Filing Jointly | Unmarried |

| 0% | $0 – $94,050 | $0 – $47,025 |

| 15% | $94,051 – $583,750 | $47,026 – $518,900 |

| 20% | Over $583,750 | Over $518,900 |

2. Short-Term Capital Gains

Short-term gains are applied to crypto-assets that have been held for less than 365 days. Unlike long-term gains, short-term gains do not receive any special treatment. Short-term gains are analogous to income from a job and are thus subjected to taxes according to income slabs.

As of 2024, the short-term capital gains range from 10% to 37% depending on a few parameters and are treated as taxes on ordinary income.

| Tax Rate | Married, Filing Jointly | Unmarried |

| 10% | $0 – $23,200 | $0 – $11,600 |

| 12% | $23,201 – $94,300 | $11,601 – $47,150 |

| 22% | $94,301 – $201,050 | $47,151 – $100,525 |

| 24% | $201,051 – $383,900 | $100,526 – $191,950 |

| 32% | $383,901 – $487,450 | $191,951 – $243,725 |

| 35% | $487,451 – $731,200 | $243,726 – $609,350 |

| 37% | Over $731,200 | Over $609,350 |

The Two Types of Taxes on Bitcoin and Other Cryptocurrencies: Capital Gain vs. Income

As mentioned earlier, cryptocurrencies are taxable and in the United States, and there are two types:

- Capital Gains Tax, similar to bonds, stocks, and other assets that qualify for capital gains.

- Income Tax includes mining, staking, airdrops, and other related crypto activities from where one can earn income.

In the case of capital gains, the rates depend on the holding period and are classified as:

- Short-term capital gains tax, taxes on assets that are held for less than a year. The rates are usually higher and range from 10% to 37%.

- Long-term capital gains tax, taxes on assets that are held for a period longer than a year. The rates for long-term capital gains range from 0% to 20%.

Here is a list of activities that fall under capital gains tax vs. income tax.

Capital Gains Tax Activity

The gains from the following activities qualify for capital gains tax activities:

- Selling crypto for fiat currency

- Buying goods and services using cryptocurrencies

- Trading one crypto for another

Income Tax Activities

The earnings from the following activities are subject to income tax:

- DeFi lending

- Receiving crypto via airdrop

- Receiving crypto as a reward or bug bounty

- Earning crypto by staking and liquidity pools

- Earning crypto mining income from transaction fees or block rewards

- Minting an NFT as an artist/creator

- Receiving token rewards from play-to-earn games (Such as Axie Infinity)

Crypto Tax Calculation Example

Suppose your annual income is $55,000 and you file your taxes as an unmarried individual.

On August 1st, you purchased $500 of BTC and sold it a year later, on July 1st for $1,500. Your gain of $1,000 will qualify for short-term capital gains at the rate of 22%, resulting in 0.22 (tax rate) * $1,000 (capital gain) = $220 (tax owed).

Sale price of assets – Cost of acquiring assets = Short-term gains

Sale price = $1,500

Cost of acquiring assets = $500

$1,500 (sale price) – $500 (cost of acquiring) = $1,000 (gains)

This gain of $1,000 is a short-term gain as the assets were sold within a period of 11 months.

Annual income = $55,000, and the short-term capital gains tax rate for this income is 22%.

So, tax owed = 22% * Capital gains = 0.22 * $1,000 = $220

Another example is your annual income is $35,000 and you bought $500 of BTC on August 1, 2023. If you sell it at $1,500 on August 2, 2024, you incurred a long-term capital gain of $1,000. According to the rates tabulated above, you’ll have to pay 0% taxes. Thus, no federal taxes will apply.

Sale price of assets – Cost of acquiring assets = Long-term gains

The sale price = $1,500

The cost of acquiring assets = $500

$1,500 (sale price) – $500 (cost of acquiring) = $1,000 (gains)

This gain of $1,000 is a long-term gain as the assets are sold after a period of 1 year.

Annual income = $35,000, and the long-term capital gains tax rate for this income is 0%.

Understanding Tax Calculation Accounting Methods: FIFO, LIFO, HIFO

When you sell your crypto, you have to pay taxes (capital gains or income) which can be calculated using the formula:

Value at the time of selling – Cost Basis = Capital Gain

However, if the value at the time of selling is higher than the value at the time of purchase (purchase price), you’ll incur a capital loss. This loss can be used to offset your capital gains in a particular year with a method known as tax-loss harvesting. (More on this later)

Now, the accounting method you choose to calculate your taxes decides how much tax you have to pay and can also significantly reduce your taxes. The most popular tax calculation accounting methods are:

- FIFO (First-In-First-Out)

- LIFO (Last-In-First-Out)

- HIFO (Highest-In-First-Out)

In order to understand each of these accounting methods, let’s look at a simple example. Suppose, on April 1st, Jake purchased $3,000 of ETH. In May, he purchased another $3,500 of ETH, and on July 1st he sold ETH for $4,000.

Now, what will be the capital tax that he pays on his gains? Let’s explore method by method.

FIFO (First-In-First-Out)

According to the FIFO accounting method, the assets that are bought first are counted first. Let’s calculate the tax in the above example.

Selling price = $4,000

Cost price (April) = $3,000

Capital gain = $1,000

LIFO (Last-In-First-Out)

According to the LIFO accounting method, the assets that are bought last are counted first. Let’s calculate the tax in the same example.

Selling price = $4,000

Cost price (May) = $3,500

Capital gain = $500

Now we can see that using the LIFO method, instead of the FIFO method will save you $500 on your capital gains.

HIFO (Highest-In-First-Out)

According to the HIFO accounting method, the assets that are priced the highest are considered first. In the given example, it would lead to the same gains as the LIFO method, but in the case of hundreds of transactions, the gains would significantly vary.

Which Crypto Tax Accounting Method Is Best For You?

Even though LIFO and HIFO can help you shield yourself from paying hefty taxes, FIFO is the most common method among taxpayers.

It must also be noted that if you intend to use the LIFO or the HIFO method for gains calculations, you have to keep a detailed record of all your transactions. Only then you can calculate the gains in a hassle-free manner.

This was all about calculating your capital gains, but what if you incur losses? Let’s explore tax losses and how harvesting those losses can help you minimize your tax obligations.

Crypto Tax-Loss Harvesting

We know that whenever we sell real estate, stocks, or virtual currency for a profit, we have to pay capital gains tax on the earnings. But a number of investors opt to sell a part of their assets at a loss, in order to reduce the capital gains and hence, the tax liability in a particular year, which is known as tax-loss harvesting.

Crypto Tax-Loss Harvesting Example

Let’s consider that Tim gained $10,000 on Ethereum this year, but he also owns a few Ripple that he bought a couple of years ago at $8,000, which is now priced at only $2,000.

Tim can now “harvest” his Ripple losses by selling it or exchanging it for another crypto. This results in a taxable event and $6,000 in capital losses ($8,000 – $2,000).

Tim’s $6,000 loss brings his total capital gains to $4,000. ($10,000 – $6,000).

Advanced Crypto Tax Situations with Examples

Whether you’re new to crypto or not, it is essential to understand advanced crypto tax situations such as aidrops, mining, staking, and their specific tax implications.

Crypto Airdrops

If you have free coins sent to your wallet, it is termed an “airdrop.” In this scenario, the way you utilize the coins will have an impact on how they’ll be taxed. Since airdrops are similar to free money received as part of a giveaway or a lottery victory, they will be taxed as ordinary income at the fair market value on the date of receipt.

Example:

Suppose Alan received 300 UNI tokens in the Uniswap airdrop of September 2020, when the tokens were priced at $3.50. On claiming the tokens, he earned $1050 (300$3.50). Thus his cost base is equivalent to his income, i.e., $1050.

Two months later he sold his 300 UNI for $2500. As mentioned earlier, this is a taxable event and he incurred a gain of $1,450 ($2500-$1050).

Crypto Forks

In the crypto world, when a blockchain experiences a diversion into two paths forward, it is called a fork and the crypto you receive as a result of this fork is taxed as income. Forks can also be understood as a protocol change resulting in a permanent diversion from the legacy distributed ledger.

Example:

In July 2021, Eric owned 3.5 ETH and as a result of the Bitcoin Cash hard fork he received 3.5 Bitcoin Cash.

He would earn $1,575 ($4503.5) if Bitcoin Cash was trading at $450 per BCH on the day he received it. Therefore, Eric’s cost basis on Bitcoin Cash will be $1,575.

Earned Income

If you earn cryptocurrency from a job, staking, or mining, your earnings will be considered as ordinary income and will be reported accordingly.

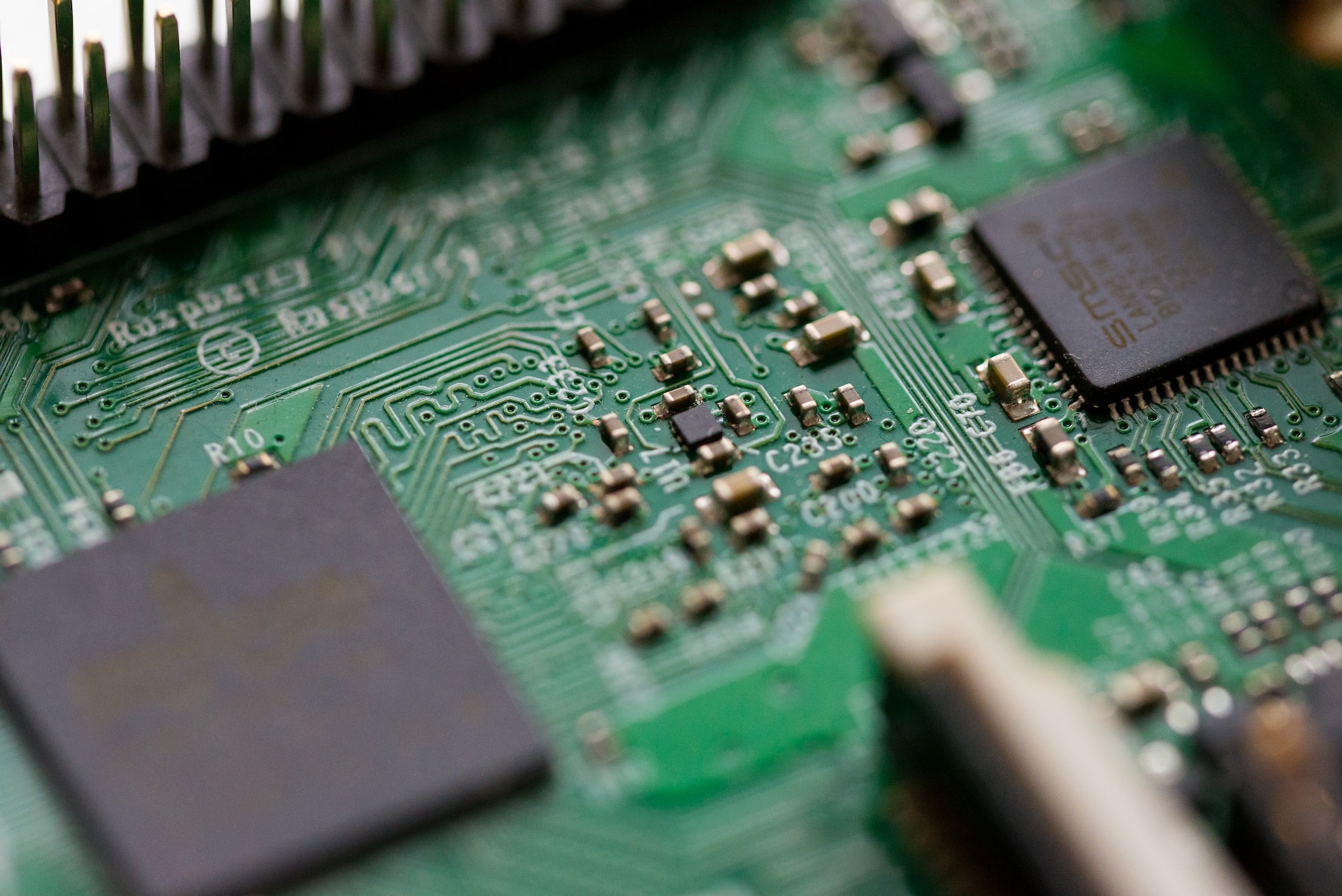

Mining

Crypto mining taxes are analogous to regular income taxes. When you successfully mine virtual currency, you create a taxable event, and you must declare the fair market value of the mined coins as gross income at the time of reporting crypto taxes.

The process of reporting crypto mining taxes depends on whether the miners are hobby miners or professional miners.

Hobby Miners

- Income to be reported in line 21 (other income) of your Form 1040 Schedule 1 (Additional Income and Adjustments to Income)

- Direct expenses of mining to be reported on a Schedule A (Itemized Deductions) and miscellaneous expenses are subject to 2% of AGI limitation (applies only to 2017 and prior years)

Professional Miners

- Both income and expenses to be reported on a Schedule C (Profit or Loss from Business) or on applicable business returns (Form 1065, Form 1120, and Form 1120S)

- Income can be subject to the 15.3% self-employment tax

- Offset mining income by deducting business expenses

Crypto Mining Taxes

The formula for calculating your gains and losses is:

Sale Price – Cost Basis = Capital Gains/Loss

The value of the coin at the moment it was mined is your cost basis (the amount included as ordinary income). To calculate your capital gain or loss, you have to subtract this amount from the price you sold the mined coins for.

You get a capital gain if the value of the coin is higher than your cost basis at the moment of selling. If the value is less than the market value, the taxpayer will suffer a capital loss. An IRS 8949 cryptocurrency tax form must be filled out for every sale or transfer of mined cryptocurrency.

Example:

Suppose John earned 0.20 BTC from mining on a day when Bitcoin was worth $34,000 ($.20 * $34,000 = $6,800). The price of BTC grew to $38,000 at the end of the tax year (.20 * $38,000 = $7,600). However, because the taxable event occurs when bitcoin is deposited, even though the asset’s current value is $7,600, you would still be taxed on $6,800 of income.

Staking/Farming

Proof of Stake is a consensus technique that allows blockchain networks to use less energy while retaining a reasonable level of decentralization. If you’ve earned $600 or more in a single tax year, you’ll have to report your earned income using the Form-1099-MISC (Miscellaneous Income).

Borrowing/Lending/Interest Income

If you’re earning income in the form of interest from any crypto lending operation or liquidity pool, your income is taxable. This income has to be reported on your taxes similar to mining and other staking incomes.

NFTs

NFT, short for Non-Fungible Tokens, refers to a special kind of digital asset that uses blockchain technology to verify its authenticity. It can include JPEG, MP4, and also GIF. Each of these NFTs has a unique ID that can be verified to identify the one who minted, produced, and initially held it.

Taxable NFT Activities

- In exchange for bitcoin, you sell an NFT

- Using a fungible coin to buy an NFT

- An NFT is exchanged for another NFT

Buying and selling NFTs will incur capital gains or losses depending on how the fair market value of the tokens you used for the transaction has changed since you got them. Also, if you are the creator of NFTs, the revenue that you get is considered regular income and will be taxed appropriately.

Thus, there are two types of NFT tax rates:

Investor Taxes

The majority of people that deal with NFTs are investors. These are the individuals that are active in the open market purchase and sale of NFTs. Investor taxes occur when people buy and sell NFTs.

Creator Taxes

Creators are the people who mint or manufacture NFTs and then sell them on websites like SuperRare and OpenSea. NFTs are not taxable for creators. The Internal Revenue Service, on the other hand, considers any crypto transactions using NFTs to be taxable (IRS).

Donations & Gifts

Donations to a tax-exempt charitable organization are considered tax-free. If you are donating $500 or more, it must be recorded on Form 8283. The amount of your tax-deductible donation is calculated by how long you have owned the assets:

- If you have held your crypto assets for more than a year, 30% of your gross annual income is deducted

- If you have held your crypto assets for less than a year, 50% of your gross annual income is deducted

In the case of gifting crypto assets, you can gift up to $15,000 per friend or family member and are tax-free for the recipient.

Margin Trading

The Internal Revenue Service has not specified any guidelines pertaining to margin trading, but we may deduce the likely approach based on prior guidelines. The most common strategy would be to treat borrowed funds as your own investment and pay capital gains tax on margin trading profits and losses.

Governance & Incentive Tokens

Governance and incentive tokens are issued by DeFi networks for being active on their platform. These tokens are taxable as income depending on the market value of those tokens. On selling these tokens, you’ll qualify for capital gains or losses.

Liquidity Pools

The revenue that is generated from liquidity pools is taxed as capital gains and income in the following ways:

- Capital gains: You are subjected to capital gains if the liquidity pool token balance remains constant but rises in value owing to demand or fee collection.

- Ordinary income: You are subjected to ordinary income if you are getting direct interest in the underlying asset.

Losses from Hacks & Thefts

Losses on cryptocurrency investments due to scams, hacks, or other thefts are not treated as casualty losses, but instead, as investment losses.

According to tax code 165 (c)(ii), even though the investment is not linked to any business, your investments have been put in for profit. This is why any loss that has occurred as a result of scams, theft, or fraud is tax losses. But how can you claim such losses when filing taxes?

Crypto losses as a result of hacks and theft can be claimed as $0 proceeds transactions on Form 8949. This implies that if you paid $15,000 for 1 ETH and it was taken as a result of an exchange breach, you might claim a loss of $15,000.

How To Prepare For Crypto Tax Season

We now know the basics of crypto taxes, their calculations, and the various taxable vs. non-taxable events. It’s time to move on to one of the most important sections of the tax guide—How best to prepare for crypto tax season?

Keep Records

All crypto activities such as airdrops, earning interest as other crypto events mentioned above are considered taxable events under capital gains or income tax events; and according to the Internal Revenue Service, “you must keep a record of all your crypto purchases and sales.”

The most popular crypto exchanges and software have a built-in feature of reporting tools that can automatically help you create crypto transaction reports.

Gather Your Information (Form 1099-K & Form 1099-B)

The Form 1099-K and other related 1099 forms of the Internal Revenue Service are provided by most of the crypto exchanges like Kraken, Coinbase, etc. All the 1099 forms serve the same purpose, which is to report non-employment income to the Internal Revenue Service.

Apart from the 1099s, there are many other crypto tax forms that you will need to file as per your requirement and the crypto activities that you have undergone.

Calculate Gains And Losses With Crypto Tax Software

The easiest way to calculate your capital gains and losses is using crypto tax software. Crypto tax software is integrated with major crypto exchanges, blockchains, and wallets, and can help you with reporting and filing your crypto taxes.

At ZenLedger, you can use our crypto tax calculation software to simplify Bitcoin tax reporting and financial analysis in compliance with the IRS and the SEC rules and regulations.

Reporting Cryptocurrency On Your Taxes

Let’s get to the final step of understanding US crypto taxes by learning how to report cryptocurrency taxes.

It is easy to get confused as to which IRS tax form is required for what purpose. As we already know crypto investing leads to the generation of capital gains taxes, and activities like mining, staking, and rewards collection will lead to income taxes.

Most important tax forms in the United States:

- Form 1040 Schedule 1 reports additional income.

- Form 1040 Schedule D reports capital gains and losses.

- Form 1040 Schedule A reports charitable donations.

- Form 1040 Schedule C reports profits or losses from businesses.

- Form 8949 reports short-term and long-term capital gains.

- FinCen 114 & FBAR report foreign financial accounts.

Other Forms Issued by the Exchanges

A crypto exchange could issue Forms such as 1099-B, 1099-MISC, and 1099-K.

1099-B

Forms 1099-B report cost basis when available. It is used to report capital gains and losses incurred by the taxpayer after selling certain assets via exchanges and barter exchanges. The IRS and the investor both receive a copy of this form for crypto transactions from the crypto exchange.

1099-MISC

This form covers a wide range of payments such as referral bonuses, crypto earnings, and other incomes. If you’ve earned more than $600 in crypto or bonuses this year, this form will be sent to you by your crypto exchange that issued the payments.

1099-K

Some crypto exchanges issue Form 1099-K. This form sums up the number of electronic payments a taxpayer has received throughout the year made by credit card, debit card, or online payments system such as PayPal.

The Form 1009-K is for taxpayers that accept payments via electronic means instead of people who sell their properties such as crypto tokens.

When some exchanges issue Forms 1099-K, they only include the total value exchanges and not the proper adjustments for cost basis. For instance, if an investor bought Bitcoin for $100,000 and sold it for $90,000, the taxpayer and the IRS will receive Form 1009-K with $90,000 as income received.

Due to this miscalculation, many exchanges have stopped issuing this form and many have exchanged this form for 1099-B because it is an accurate tax form and provides the user experience, and eliminates the possibility of an IRS audit.

Simple Tactics to Minimize your Crypto Taxes in 2024

1. Utilize crypto tax software: These platforms, like TokenTax, streamline the tax filing process by aggregating data from all your crypto transactions across exchanges, wallets, and protocols. They automatically generate detailed tax reports, including capital gains and losses, ensuring accurate reporting to tax authorities.

2. Harvest your crypto losses: Selling cryptocurrencies at a loss allows you to offset capital gains and up to $3,000 in ordinary income, reducing your overall tax liability. Additionally, any unused losses can be carried forward to offset future gains, providing ongoing tax benefits.

3. Hold crypto assets long term: Holding onto your cryptocurrencies for over a year qualifies you for long-term capital gains tax rates, which are typically lower than short-term rates. This strategy incentivizes long-term investment and can significantly reduce your tax burden when you eventually sell your assets.

4. Consider selling during a low-income year: If you anticipate a decrease in your personal income in a particular year, consider selling some of your cryptocurrencies during that time to take advantage of lower tax rates. This proactive approach allows you to optimize your tax situation based on your income level.

5. Give cryptocurrency gifts and donations: Gifting cryptocurrency to friends and family members can be a tax-efficient way to share your wealth, as it doesn’t trigger income tax for either party. Additionally, donating cryptocurrency to qualified charitable organizations allows you to offset capital gains taxes while supporting causes you care about.

6. Explore retirement accounts: Investing in cryptocurrencies through self-directed IRAs or 401-Ks can offer significant tax advantages. By holding your assets within these accounts, you can grow your investments tax-free and defer taxes until you make withdrawals during retirement.

7. Take out a crypto loan: Instead of selling your cryptocurrencies and incurring taxable events, consider taking out a loan using your crypto holdings as collateral. This strategy allows you to access liquidity while retaining ownership of your assets and deferring tax consequences until later.

8. Consider relocating: Moving to a jurisdiction with favorable tax treatment for cryptocurrencies can substantially reduce your overall tax burden. However, it’s essential to consider factors such as residency requirements and potential implications for other aspects of your financial life.

9. Keep detailed records: Maintaining comprehensive records of all your cryptocurrency transactions is essential for accurate Bitcoin tax reporting and compliance. Documenting details such as acquisition dates, purchase prices, and transaction fees ensures that you can calculate capital gains and losses accurately.

10. Seek professional assistance: Consider seeking professional guidance from an experienced crypto tax accountant or advisor. Their expertise can offer invaluable insights and personalized advice to address your unique circumstances. With their assistance, you’ll gain support in navigating intricate tax regulations, pinpointing potential avenues for tax savings, and maintaining adherence to regulatory standards.

In Latest News: Biden Budget Plan proposes taxes to reduce crypto wash trades

President Biden’s upcoming budget aims to tackle tax loopholes in crypto trades, especially wash sales. This follows previous attempts to regulate crypto, like the bipartisan infrastructure bill. However, concerns linger about the bill’s broad definitions and amendments to tax code 6050I, leaving the crypto industry uncertain about compliance.

The Financial Takeaway – How is Bitcoin and Cryptocurrencies Taxed?

The IRS published guidelines on cryptocurrencies back in 2014 and hasn’t updated them much since then. However, it pretty much summed up for many crypto investors. If you earn a profit from trading it or using it, you have to pay taxes. If you accepted it as a payment or earned income from it, you have to pay taxes. Even though it sounds easy, the crypto tax space is pretty complex and we hope our crypto tax guide has helped.

ZenLedger easily calculates your crypto taxes and also finds opportunities for you to save money and trade smarter with our portfolio tracker. Get started for free now or learn more about our tax professional prepared plans!

Disclaimer: This material has been prepared for informational purposes only, and is not intended to provide tax, legal or financial advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.