Blockchains are great digital asset registries since they are secure and immutable. While cryptocurrencies have become synonymous with blockchain, you can use the same technology to store your digital items. The rise of non-fungible tokens, or NFTs, marks a step in that direction and opens the door to digitizing several different assets.

Let’s look closer at NFT crypto tokens, how they differ from traditional tokens, and how the IRS will likely treat them for creators and investors with our comprehensive NFT tax guide.

In Latest News: Spain’s finance ministry targets crypto, NFTs with new tax reform

What Are Non-Fungible Tokens?

Non-fungible tokens, or NFTs, are a particular type of cryptographic token representing a unique asset. For example, The Bored Ape Yacht Club NFTs, pictured above, each have unique properties via metadata that are verifiable along with ownership on the blockchain. These dynamics differ from fungible tokens, like Bitcoin, as they are non-unique and interchangeable.

Conventional Tokens

- Fungible

- Maybe securities

- Standardized and regulated

NFTs Non-Fungible Tokens

- Every item is unique

- Not usually securities

- A diverse set of use cases

- A diverse set of regulations

On a technical level, fungible ERC-20 tokens contain a name, balance, token supply, and symbol. The non-fungible ERC-721 (and other) tokens have rich metadata that you can check to provide asset details or additional authenticated information. These metadata capabilities allow NFTs to do everything from verifying academic credentials to recording real estate ownership to providing special access or privileges.

Now, let’s see how an NFT works.

How do NFTs work?

Mostly, NFTs exist in the Ethereum blockchain, an open-source distributed public ledger. NFTs are minted from digital objects that symbolize tangible as well as intangible items such as:

- GIFs

- Art

- Collectibles

- Music

- Designer sneakers

- Videos and sports highlights

- Virtual avatars and video game skins

Strangely enough, you can even convert tweets into NFTs. Jack Dorsey, Twitter’s co-founder, created an NFT of his first-ever tweet and sold it for $2.9 million. Look at NFTs as a collector’s item but only digitally, so when you buy one, rather than hanging an actual oil painting on the wall, you get a digital file.

But that’s not all. You also get exclusive ownership rights of the NFT, which can have only one owner at a time. The unique data of an NFT makes it easy to verify the ownership and transfer of NFT crypto tokens. The creator or the owner can also store certain information in an NFT token, such as their signature in the metadata.

The Several Emerging Uses of NFTs

- Artists are shifting their creative assets to NFTs, which allows them to build a stronger community and collect royalties from secondary sales, as well as prevent piracy.

- Marketplaces can help create liquidity for NFTs, such as OpenSea.

- Infrastructure providers can use NFTs for licensing, domain names, or certificates.

- Physical assets, like real estate, can eventually be stored on the blockchain with NFTs.

NFTs are relatively novel, and their primary use cases will likely change as they gain mass adoption. In today’s world, most people know NFTs as art/collectible pieces—most with little to no utility. In the future, NFTs will be everything from music royalties and fan tokens with special privileges to making things like education diplomas and biospecimen verifiable on the blockchain.

Now that we know how NFTs work, let’s talk about how NFTs gain value.

How Do NFTs Gain Value?

Like any piece of art, an NFT crypto token’s value depends on the artist’s credibility in the physical world, the artwork’s nature, the time and effort devoted to creating the artwork, the story that inspired the artwork, and the artist’s social currency.

As per experts, if an NFT has a physical presence, its price is usually between 1-10% of the tangible art piece. However, the creator is the primary determiner to set the price of the NFT itself.

The experts also say that there is no particular rule that sets the value of an NFT, but they primarily look at a couple of factors. First is the rarity or ‘hard-to-get’ aspect of an NFT, and the second is its application in the real or the digital world. These two characteristics give an NFT crypto token immediate value, which builds up over time.

When Do I Owe Taxes On An NFT?

The IRS has clarified that transacting in virtual currencies will result in some sort of tax on any gains. According to IRS Notice 2014-21, virtual currencies are a digital representation of value that functions as a medium of exchange, a unit of account, and a store of value—and both conventional crypto tokens and non-fungible tokens fall under that definition.

The IRS considers most conventional crypto tokens as securities since they are fungible and standardized. While the IRS may be unable to track individual tokens, exchanges must report aggregate activity. The agency has used that data to generate letters sent to crypto traders and investors urging them to pay their fair share of taxes.

Since non-fungible tokens are unique by nature, it’s much easier to identify sold units—just like you would with a bond’s CUSIP or a stock’s certificate number. The IRS may classify the tax on NFTs as regular income, capital gains, or tax-exempt depending on what the NFT is and the substance of the activity is with the NFT, given its many use cases.

For example, suppose that you purchase an NFT that represents a real estate asset. The token is merely a digital representation of a physical asset, which means that the taxation of the asset will mirror that of real estate rather than cryptocurrencies. You may be eligible for real estate-related deductions, such as depreciation, to offset gains.

What Is The Tax Rate On NFTs?

Whenever you profit from increasing demand in cryptocurrency, it is subject to regular capital gains taxes. But in the case of NFT transactions, this doesn’t stand true since NFTs can be considered collectibles and qualify for higher capital gains tax. However, in some rare circumstances, it can be considered as inventories, thus being subjected to income tax rates.

When Are NFTs “Collectibles”?

IRS Notice 2023-27, Treatment of certain non-fungible tokens as collectibles, clarifies that the Department of the Treasury and the IRS intend to issue guidance related to treating NFTs as collectibles under section 408(m) of the tax code.

While section 408 limits collectibles to “tangible personal property,” the IRS intends to use a “look-through analysis” to determine if NFTs are collectibles associated with a physical item. In essence, the IRS wants to ensure you pay the taxes when its value represents a physical asset that makes it valuable, such as a collectible trading card or rare wine.

The determination matters because long-term capital gains rates vary from 0% to 20%, depending on your tax bracket, whereas they tax collectibles at a flat 28% rate.

At the moment, you should remember that the IRS intends to use a look-through analysis when assessing whether an NFT is a “collectible.” So, if you own NFTs representing a physical item and have a value that aligns with that item, you may want to classify it as a “collectible.”

NFT and Taxes: What Are Investor Taxes?

Most individuals dealing with NFTs are investors—those buying and selling NFTs in the open market. For them, taxes work the same way as they do for crypto trading.

Purchasing NFTs

When you buy NFTs using cryptocurrency, it is taxable.

For example, years ago, Kim purchased 2 ETH @ $500/ETH ($1000 total). In March 2021, Kim used this same 2 ETH to purchase a Bored Ape NFT, but ETH is now worth $1000 so the purchase of the Bored Ape is for $2000. Kim incurred a capital gain of $1000 from the increase in value of her 2 ETH, which is taxable upon exchange for the NFT.

Is sales tax applicable to NFT purchases?

Certain states such as Washington and Pennsylvania have included NFTs in their roster of digital goods subject to sales tax.

It’s essential to note that the obligation to collect sales tax lies with NFT creators and sellers operating as businesses—not with individuals engaging in NFT transactions.

Historically, the Supreme Court has decreed that businesses conducting over 200 transactions or generating $100,000 in sales within a state are liable for sales tax. It’s reasonable to expect these criteria to extend to NFT creators in states where NFT sales tax regulations are implemented.

However, compliance can be challenging for NFT creators. Presently, platforms like OpenSea and Rarible do not collect user addresses, making it exceedingly difficult to ascertain buyers’ state of residence.

Creators who meet the sales tax threshold for NFTs should seek guidance from tax professionals on maintaining compliance with state laws and regulations.

Selling NFTs

Another taxable event is selling your NFT for crypto, fiat currency, other NFTs, or goods and services.

Let’s take the same example. If Kim sells her NFT for $12,000 after six months, it would qualify for short-term capital gains of $10,000 ($12,000-$2,000). Short-term gains are taxable as ordinary income rates of tax.

NFT and Taxes: What Are Creator Taxes?

The creation of NFTs is not taxable. However, any crypto transactions related to NFTs are considered taxable, according to the Internal Revenue Service (IRS).

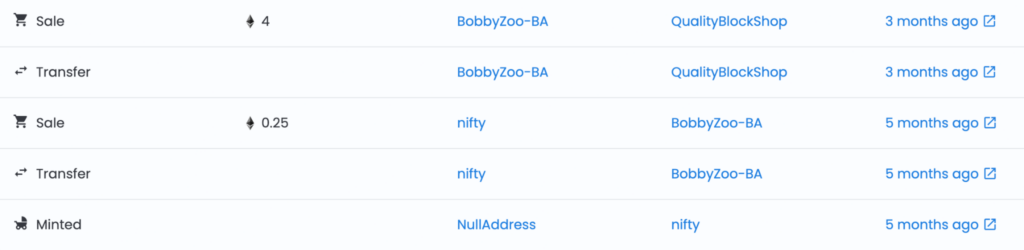

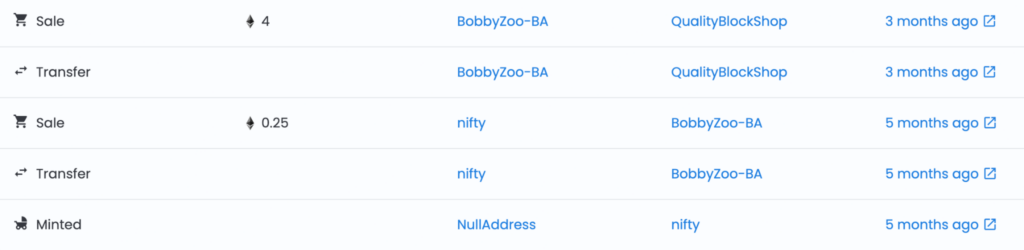

Creators are the ones who mint or create NFTs and list them for sale on various marketplaces, such as SuperRare and OpenSea.

NFT creators are of two types:

- Hobby creators

- Professional creators

Hobby creators mint NFTs for fun, whereas professional creators mint NFTs as a full-time trade.

Minting NFTs

Gas expenses paid for minting NFTs are taxable. Let’s understand this with an example.

Tim mints NFTs as a hobby. He spent 0.2 ETH to mint a Bored Ape NFT. When he initially purchased this ETH, it was $200. At the time of the NFT mint, this same 0.2 ETH increased in value to $400. Therefore, minting the NFT with this ETH will incur a $200 ($400-$200) capital gain, whereas the cost basis for the NFT he minted is $400.

On the contrary, had Tim been a professional creator, $200 would have been his ordinary income, and the cost basis would’ve been $400.

Selling NFTs

Selling NFTs for any crypto or exchanging an NFT for another NFT is taxable for NFT creators.

Suppose Tim holds his Bored Ape for nine months and sells it for 5 ETH, now worth $15,000. Since he held the NFT for less than one year, Tim will incur a short-term capital gain of $14,600 ($15,000 – $400{cost basis}). If Tim had held the NFT for more than one year, his profit would be considered a normal capital gain (not short-term).

If Tim were a professional creator, he would have reported his $14,600 as ordinary income. He could also offset his gains by filing Schedule C for deducting internet, utilities, and other business expenses.

NFT Royalties

Earning recurrent royalties is taxable as well.

Suppose Banksy releases a piece of artwork as an NFT, with 1% royalties attached in perpetuity. After the initial mint, the NFT was resold several times on the secondary market, and Banksy received 1% of each sale as his royalty. After the first secondary sale, Banksy earned 0.30 ETH in royalties, so he would have to report an ordinary income equivalent to the USD value of this ETH when he received it.

NFT Airdrops

Holders of popular NFT projects like Cryptopunks and Bored Ape Yacht Club will often find that they’re being airdropped (given for free) coins or other NFTs that have monetary value. Oddly enough, airdropped tokens are one of the few things the IRS has provided explicit guidance on; they tax airdrops as ordinary income. The amount of this income is the value in USD of the airdropped coins/tokens at the time they hit the wallet.

What are the Tax Implications of NFTs in Play-to-Earn Games?

In cryptocurrency-based gaming, players can acquire and exchange in-game items represented as NFTs. For instance, in Axie Infinity, a popular game, players can buy, breed, trade, and battle with NFT avatars called Axies.

Transactions involving in-game NFTs are expected to adhere to similar taxation regulations as other NFT transactions. Purchasing an NFT with cryptocurrency and selling one within a game such as Axie Infinity will probably be deemed disposal events, thus subject to capital gains tax.

Which NFT Transactions are Exempt from Taxation?

The act of creating an NFT does not trigger taxable events. Nevertheless, if you’re a professional NFT creator engaged in full-time minting, you’re required to report NFT earnings and business-related expenditures. Additionally, royalties earned from NFTs and gas fees incurred during NFT minting are also subject to NFT taxation.

How to Report NFT on Taxes

Reporting NFT transactions is different for hobby creators and investors than for professional creators and investors.

Hobby Creators And Investors

- IRS Form 8949 and Schedule D

- Mention collectibles NFTs as code C in column F

Professional Creators And Investors

- Report NFT income and business expenses

- Schedule C or Form 1065, Form 1120, or Form 1120-S

Some Common NFT-Related Misconceptions

Tax Cuts & Jobs Act (TCJA)

- Enacted: 1st January 2018

- Provisions do not have implications on NFT taxes

Utility NFTs

- Not music, graphics, digital art, etc

- Provide other utilities like a NFT game like Axie Infinity, domain name, etc.

- Different tax treatments than collectibles, property, and inventory

This is how to report NFT on taxes.

Tips for Reducing NFT Taxes

- Tax-loss Harvesting – Several services enable you to sell worthless and illiquid NFTs to harvest a tax loss. These services generally provide a verified and audited smart contract-driven record and a CPA-ready receipt.

- Deduct Expenses – Creators minting NFTs must report any income as self-employment income subject to self-employment taxes. In some cases, they may be able to deduct relevant costs to reduce their taxable gain on these transactions.

- Donating NFTs – Donating NFTs to museums or putting them up for charitable auctions can help offset gross income if they were held for over a year and donated directly to a 501(c)(3) organization.

It’s important to note that, we don’t recommend finding an nft tax loophole. We recommend that you calculate your taxes accurately using ZenLedger and pay them on time rather than finding an nft tax loophole.

Did you know:IRS gives loss deduction and NFT tax treatment guidance

Final Thoughts On How are NFTs Taxed

Cryptocurrencies are only scratching the surface of what’s possible with blockchain technology. With the rise of non-fungible tokens, blockchain technology can apply to everything from digital artwork to digital representations of physical real estate assets. Of course, these transactions have tax consequences for traders and investors.

If you trade or invest in NFTs or other crypto assets, ZenLedger can help you quickly calculate your NFT taxes, find opportunities to save money and trade smarter with our portfolio tracker. Get started for free now or learn more about our tax professional-prepared plans!

Disclaimer: This material has been prepared for informational purposes only and is not intended to provide tax, legal, or financial advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.